Bank of Canada Interest Rate Announcement – April 2024

- Bank of Canada holds rates steady

- Inflation not expected to hit target until next year

- Canada employment deteriorating but wage pressures inflationary

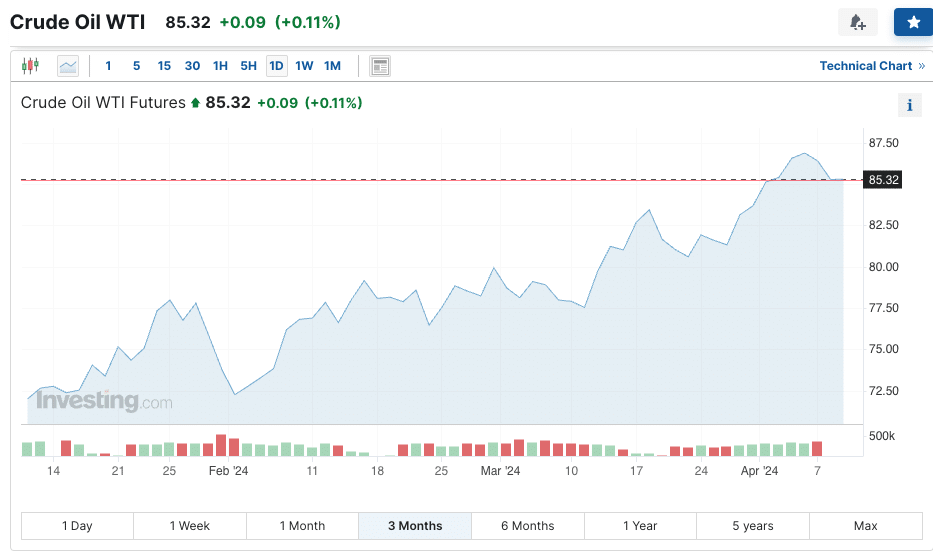

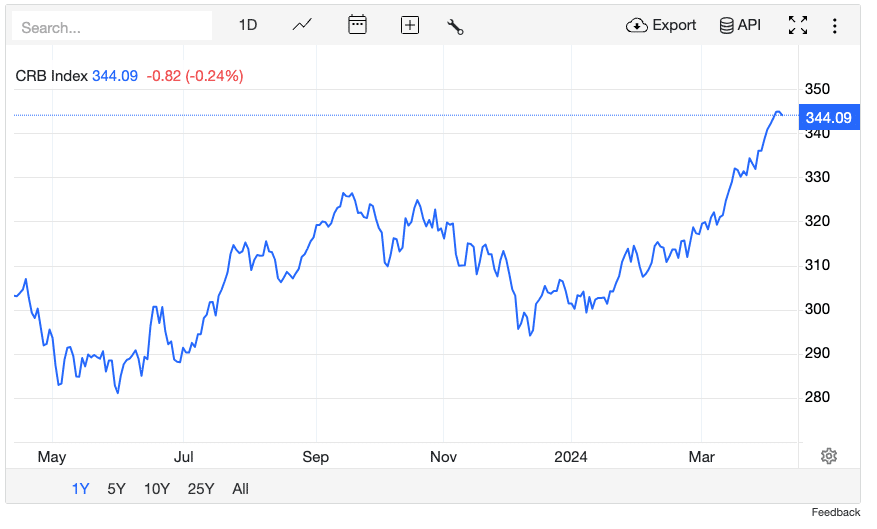

- Commodity prices now rising again (inflation)

- National emergency in productivity flagged

- housing affordability also in national crisis

No change by the Bank of Canada this morning’s interest rate announcement.

It wasn’t that long ago (leading into Christmas) that this rate meeting was expected to be the first cut. A month into the year & that timeline was quickly kicked out to where it stands now – summer.

If I had to guess, I would bet on the rate cuts starting LATER in the year. Higher for longer continues to be the name of the game here.

While the latest jobs data in Canada showed a declining employment rate (6th straight monthly decline) & rising unemployment at 6.1% (7 year high), it also showed an increase to avg hourly wages to 5.1%, which is INFLATIONARY & an issue considering the softening job market.

With the rise in commodity prices & oil over the past few months, it’s very apparent how sticky inflation is proving to be.

Remember 3 years ago when central bankers were talking off inflation as being transitory & one time booms? The Bank doesn’t expect inflation to hit the 2% target until next year.

Two weeks ago the Carolyn Rogers at the Bank of Canada came out warning of a NATIONAL CRISIS with productivity. Productivity is a measure of economic output per unit of work (or to simplify, GDP per working body) & part of the speech highlighted how weak productivity makes their job of controlling inflation much harder.

We NEED more competition. We NEED to up business investment. When productivity is weak, rising labour costs show up in higher prices.

On the home affordability front, provincial & federal authorities are rolling out measures to try to help affordability, but it’s really a bloody mess here across the country. THE issues driving high rents, house prices & mortgage rates are inflationary government spending & population growth many multiples above historical averages. There is a massive supply / demand imbalance with housing. You can’t flip a switch & magically create millions of homes, certainly not with waning business investment.

On the interest rate front, over the last 2 weeks we started to see the better promo pricing with fixed rates coming in higher as bond yields continue to bounce around. There’s about a 1% difference between the popular 3 year fixed in the low 5%s & a variable in the low 6%.

Interest rates are still relatively high. More mortgages are coming due to renewal & feeling the pinch of higher payments. If you want to get ahead of your renewal & get a sense of what you might expect, get in touch today. Every dollar counts.