Bank of Canada 0.5% rate increase – June

The Bank of Canada followed through with their 3rd increase of 2022 & raised rates by 0.5% at this morning’s rate announcement. That brings the total number of increases to 1.25% on this rate hike cycle & the same total amount as the last rate hike cycle in 2018. There are additional rate hikes being priced in for this year & the way things look now another 0.5% increase at the July meeting is looking likely.

I know for a lot of people, reading that tends to result in the knee jerk reaction of wanting to lock into a fixed but keep in mind, doing that is locking in another 1.5%+ rate hikes right away & takes on a significantly higher penalty risk if you break your mortgage early.

Psychology is a funny thing as, from the conversations I have with clients, many people tend to think that if your variable rate ends up getting to the same level as the fixed rate, then it’s been a mistake.. the reality is it’s still been a good move as you’ve saved on the way up. For a variable to end up costing more over your term it would have to continue rising & stay there.

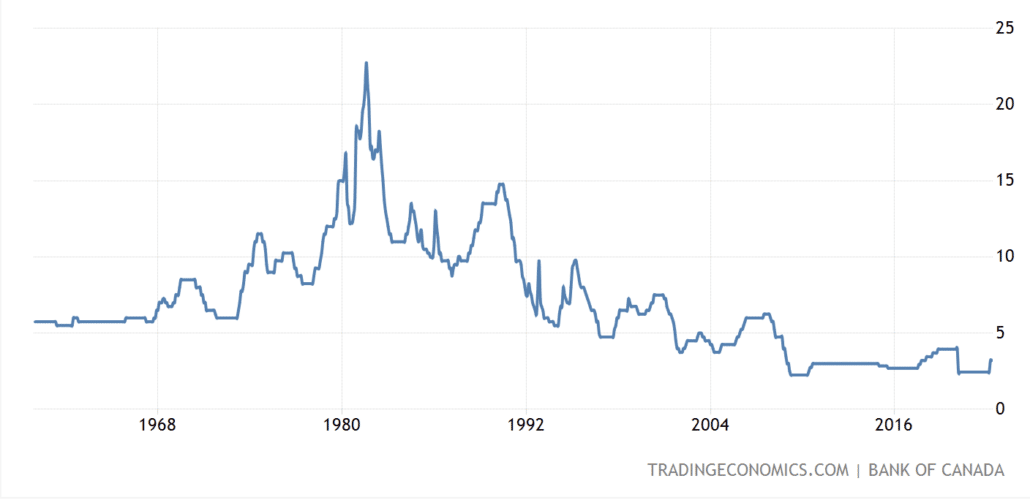

The ”stay there” is the key piece. If you look at past rate hike cycles you’ll see that anytime we’ve seen sharp rate increase like we’re seeing now, it tends to result in rates falling just as sharply & roughly a year after the rate hikes started.

HISTORY OF PRIME RATE IN CANADA

It’s called variable for a reason. What goes up, goes down & what goes up quickly, comes down quickly as the shock has a more significant impact.

I wanted to take a step back here & put into context what has happened over the last 2 years because a lot of people like to lean on the forecasters. The Bank of Canada in 2020 said repeatedly that it would not raise rates until 2023. How many people based major financial decisions around that guidance?

While they were saying that, our federal government was flooding record amounts of stimulus into the bank accounts of Canadians & I think we all heard no shortage of stories of cheques that went out to people or companies who frankly, didn’t need it.

So we had record low borrowing rates, free money flying around & of course that turbo charged demand, all at a time where lockdowns & restrictions wreaked havoc on supply chains. The Bank of Canada said repeatedly they intended to let inflation “run hot.”

All of last year inflation started to build, and build and build. In the face of the highest inflation reading in nearly 2 decades, the Bank of Canada left rates unchanged at their January meeting. Then, the rush to play catch up & come in hot & heavy with 50bps hikes.

The thing with high prices is that they are cured by high prices. Meaning, high prices take away from the potential to spend elsewhere in the economy so demand suffers. As demand goes down, so eventually will prices. Canada’s GDP for Q1 came in well below expectation at 3.1%, compared to 6.6% last quarter.

Growth is slowing. Add on to that how mortgage costs have doubled this year & you have a recipe for recession. It’s not a question of if. It’s a question of when.