Bank of Canada JUMBO cut – 0.5%

Here are the highlights:

- Interest Rate Cut:

- Bank of Canada cuts interest rates by 0.5%, lowering Prime Rate from 6.45% to 5.95%, the fourth consecutive cut.

- This brings the total rate cuts to 1.25% since June.

- Economic Indicators:

- inflation FINALLY within the target range of 2-3% (Sept came in at 1.6%)

- Employment still declining on a per capita basis

- GDP in the back half of 2024 expected to be 1.75%

- Job Market:

- Canada gained jobs last month but still not keeping pace with population growth

- Unemployment is 6.5%

- Young Canadians & newcomers being most impacted by the poor job market

- Forecasts:

- Big banks forecast further rate cuts:

- December rate cut likely

- Total of 1.25% cuts by the end of 2025.

- Big banks forecast further rate cuts:

- Next Bank of Canada Meeting:

- Scheduled for December 11th, 2024

Big news out of the Bank of Canadathis morning. Tiff & his merry band of bankers have followed the US Fed with a 0.5% rate cut. That brings a total of 1.25% since June & isn’t to be the last.

While a jumbo cut is welcomed news to borrowers, the not so great reality is that they wouldn’t be doing that if things were rock & rolling.

In the release The Bank noted subdued GDP growth in the 2nd half of this year, slightly better for next, but well below the expected 3% global growth. Declining consumption on a per person basis & soft labour market with unemployment running at 6.5% are clear signs the stifling interest rate environment are too restrictive.

| t 6.5% are clear signs the stifling interest rate environment are too restrictive. |

|

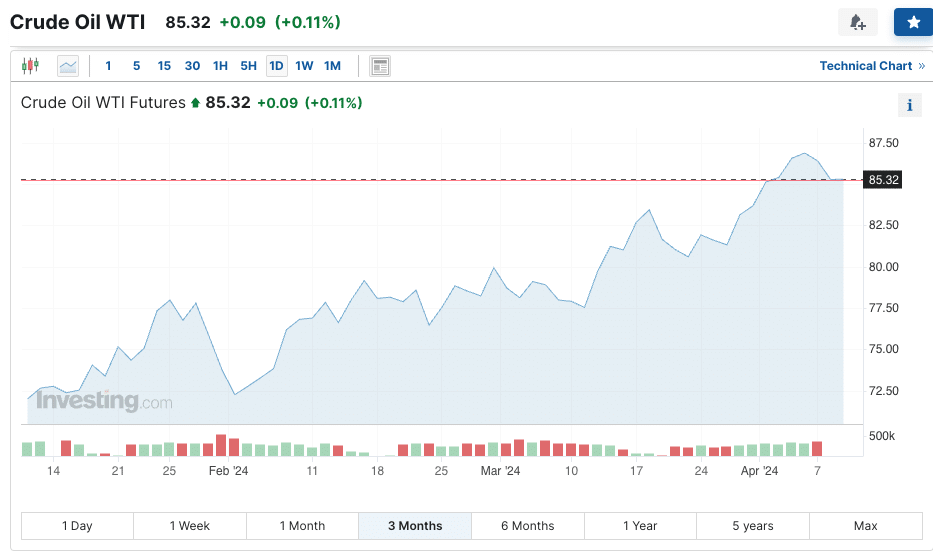

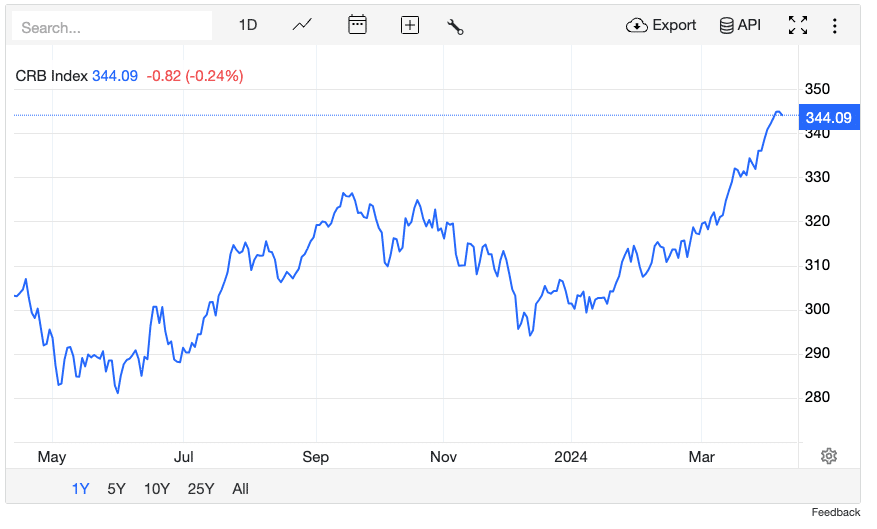

Inflation has finally subsided to fall within the acceptable range with last month’s print coming in at 1.6%, but don’t count inflation totally out for dead. Commodity prices picked up surrounding the US FED’s somewhat surprising jumbo rate cut last month & bond yields overall being higher than the summer. |

|

There is 1 more rate meeting to close out the year coming up in Dec. The market is expecting another 1% in cuts by the end of next year. |

|

The next Bank of Canada meeting is December 11th, 2024 |