Bank of Canada Dec 2023 – NO CHANGE

Good morning,

The Bank of Canada has left rates unchanged at this morning’s interest rate announcement. This wasn’t much of a surprise as inflation has continued to decelerate, , unemployment ticking up & real GDP contracting, all in spite of the positive input of strong population growth. The government of Canada bond yields, which fixed rates are priced on, have been coming down for the last 3-4 weeks.

What’s really stood out over the past month were comments by Bank of Canada Governor Tiff Macklem. Addressing the parliamentary finance committee, speaking about inflation, he commented that the central bank could begin cutting interest rates before inflation is all the way back to target. Cutting rates BEFORE inflation is back to 2%.

Why does this matter? Central bankers often use statements to guide markets (remember the, “rates will stay low for a very long time” comment in summer 2020 attempting successfully to get everyone to borrow & spend to juice the economy during covid?).

After basically 2 years of emphasizing the importance of getting inflation to 2% & all the rate hikes to get there, why the shift? Why, at this point, start opening the door for rates coming down? Does the Bank of Canada see a future where it is going to be a very long time before inflation hits 2% with an economy that needs help before then? Is it a positive thing that rates could be coming down if inflation is high?

The short answer is no. If rates are coming down while inflation is above target that suggests a pretty dire economic picture.

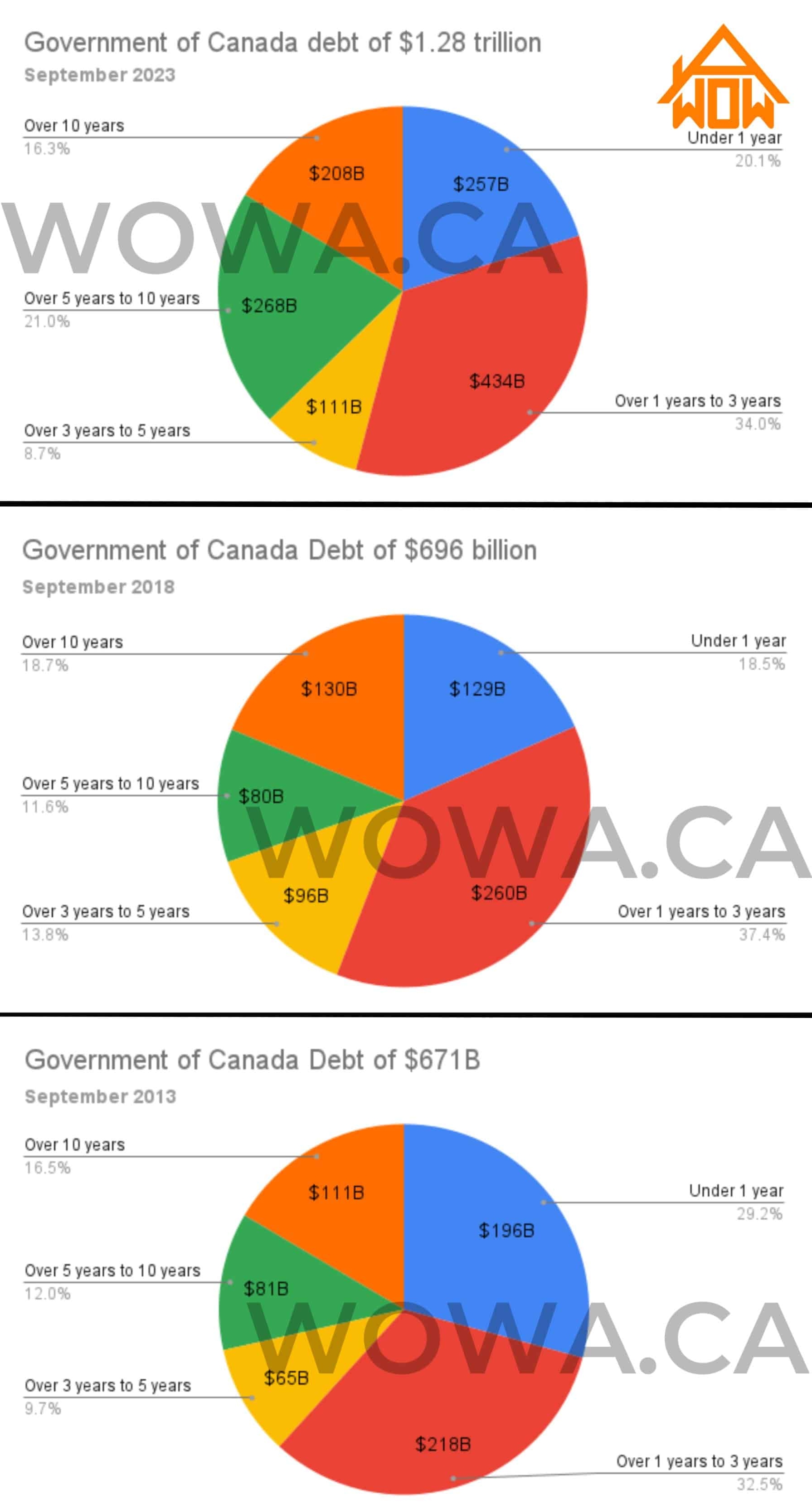

The reality is we’re in a higher cost of living regime. When you borrow, you’re pulling demand from the future & the government of Canada total debt surged by 84% in the past 5 years. 54% of that debt is coming due to renew in the next 3 years. You’re either paying for that through growth, higher taxes, or cutting government spending.

Now, don’t go buck wild on that comment. Tiff also said loosening monetary policy is still a ways off, but markets reacted on that nonetheless & are still pricing in cuts as soon as April.

To counter all that, it should be noted real GDP for Q2 was revised up from a 0.3% drop to 1.4% growth. The upcoming months were also ones where inflation was coming down at this time last year so it wouldn’t be a surprise to see higher surprises with inflation reports, but for the time being rates are settling down into the Christmas season.

That wraps 2023 for rate announcements. Have a very happy holiday season & see you in 2024.