Bank of Canada – April 2025 – NO CHANGE

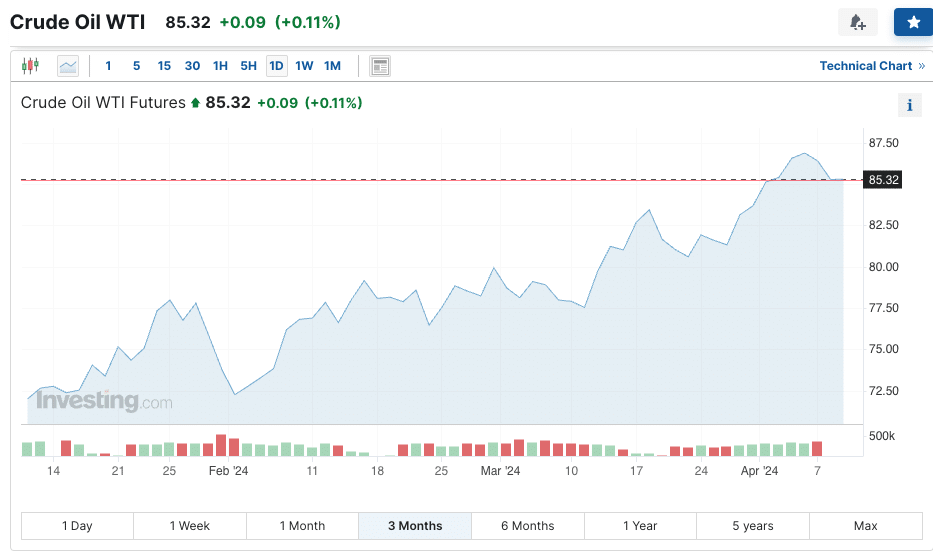

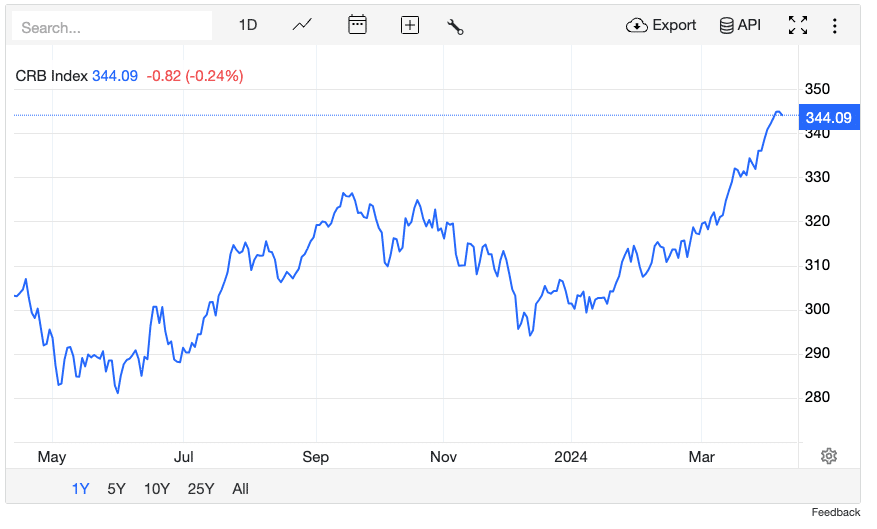

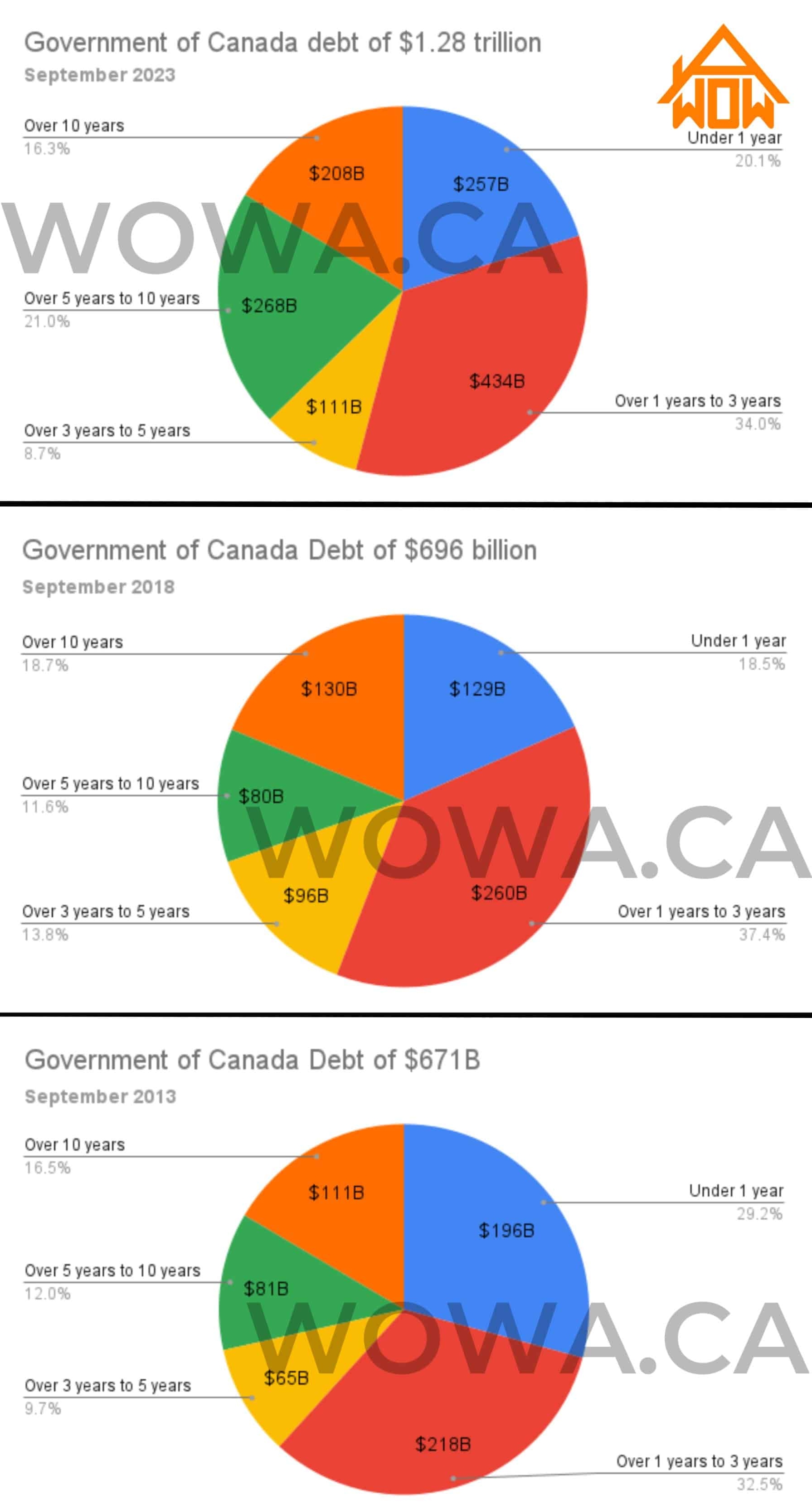

| Here are the highlights: Interest Rate Hold:Bank of Canada held interest rates, maintaining Prime Rate of 4.95%This is the first meeting they’ve held rates since April 2024The total number rate cuts this cycle is at 2.25%. Economic Indicators:inflation lower than expected at 2.3% for MarchCAD strengthened vs USD over the last monthConsumer confidence at an all time lowHome sales plummeting as tariff concerns remain Job Market:March report was weaker than expected with negative job growth (0.2%)Layoffs starting in Auto sector as a result of trade warUnemployment up 0.1% to 6.7% Forecasts:5 of the 6 Big Banks forecast further rate cuts in 2025:0.5% – 0.75% Next Bank of Canada Meeting:Scheduled for June 4th, 2025https://bbemaildelivery.com/bbext/?p=vidEmbed&id=36024853-8AB1-4FE3-A120-E2ACB4FFCE3A&ar=0&ignore_view=1&videoPlayerId=5d66952e-e212-976d-2301-585a57e910c5 The Bank of Canada held rates this morning. This is the first time they have not lowered rates since April of last year. Much of the release this morning highlighted the uncertainty of the trade war, as Trump continues his Mr Miyagi routine of tariff on, tariff off. Whether you’re a business or individual, it’s tough to stomach deploying capital in an uncertain environment & we’re seeing that follow through in the housing market. It’s a great time to be a buyer, not so great if you need to sell. Business confidence, employment, consumer & business spending are all on the decline, & that’s reflected globally with falling oil prices.  The Bank of Canada outlined 2 scenarios with the trade war:High uncertainty but tariffs limited in scope: Growth weakens temporarily & inflation remains on 2% targetProtracted trade war: causes Canada to enter recession & inflation rises temporarily above 3% in 2026Both pills spell trouble for the economy & is likely to result in further cuts throughout the year. I think what a lot of people don’t understand is that Bank of Canada rate cuts don’t have a direct correlation to fixed rates. Over the past year they’ve cut rates 2.25% but over that time the 5 year fixed has only come down 1% – 1.5%. Rate cut don’t mean ALL rates come down. The current expectation is that fixed rates might get a bit better this year, rising into next & the range of big bank expectations for Bank of Canada cuts in 2025 (ie: variable rates) range from no further action (<–Scotia is the outlier) to 0.5%-0.75% (everyone else). Tiff Macklem, like everyone else, can only wait to see what unfolds but what matters most right now, to you & your mortgage, is having the long-term protection & oversight that we’ve built into our business. If you have a renewal coming up in the next year, get in touch with us today so we can make sure you don’t miss out on any opportunities. |