Bank of Canada rate increase – 0.5% Dec 2022

Good morning,

More pain this morning as the Bank of Canada surprises markets for the 2nd meeting in a row & raises 0.5% vs the market’s expectation of 0.25%. Last meeting consensus was expecting more & we got less. This week, the opposite. As of this morning market expectations are still for another 0.25% but as we’ve seen throughout this year, this can all change for better or worse. The Bank ended their release ambiguously stating they will be considering whether the policy interest rate needs to rise further. This is a change from their typical, “more action is needed,” line but as we saw today & throughout this year, be cautious with optimism with these guys, although it does appear we are very near the end here.

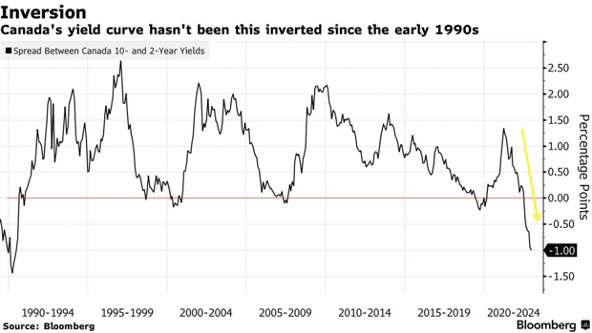

Inflation continues to come down but CPI inflation is still at 6.9% with core inflation around 5%. Canada’s 10s/2s yield curve, which gives an indication of future economic activity, is the most inverted since the early 1990s. In a health economy the curve slopes upwards, which points to economic growth into the future. When short term yields are higher than long term, the curve slopes downwards, which corresponds to periods of economic recession. The growth outlook is not good. Winter is coming.

A lot has been made over the last month of Central Bank action. The head of Australia’s central bank actually came out with an apology to people who took out mortgages last year under the guidance of rates being low until 2024. In Canada, for the first time ever our central bank ran a loss. Keep in mind that loss falls on the backs of tax payers & is looking to be something to the tune of a $10b loss – instead of collecting something around $3b annually from the Bank of Canada, we’ll be forking out approximately $7b overt the next 3 years. First time ever. Ever is a long time..

|

They also admitted they should have raised rates sooner but defended paying out $18.4m in bonuses to staff last year so more signs of how broken our world has become.

Prior to this morning, around 13% of all mortgages in Canada had passed their trigger rate, meaning their payments were not covering all the interest owed for that month. After today that number will be higher. If you’re in that boat, raise your payments, even if you have already. You want to delay the trigger situation as much as you can. Around 75% of mortgages in Canada this year were in variable rates, which, in a lot of situations had to do with broken policy pushing clients to going variable in order to have the lower stress test rate & qualify for their purchase. Also, in fairness, given the history of this central bank it was hard envision the hawkishness we ended up seeing.

Looking at my own business, what I got wrong was, we knew inflation was going to be an issue & that’s something I was talking about since 2020. We knew there was a ton of debt in the country & raising rates would be problematic, which it is & will continue to be, but what I underestimated was the level of damage that could occur between when they started raising & finished. I completely underestimated the level of pain & damage they would be willing to reign down & that is something I take very seriously. Myself & really everyone completely missed the boat on that. The conflict in Ukraine certainly didn’t help & looking back that seemed to be the point where the switch really flipped & that was used as the excuse to really move to significant increases, but whether that happened or not, inflation still would have been high & that’s not THE reason for this year.

Even though variable had been the better bet close to 90% of the time in Canada’s history, the take away for me is to really outline what could happen in that 1 time in 10 where it isn’t.

This is the last meeting for 2022. One that will surely be remembered for a long time. Next year the story will be when will rates start to drop but I would suspect mid to late 2023 before any relief comes on that front.

That’s it for me. Thanks for watching & please get in touch if you’d like to discuss.