Bank of Canada Rate Announcement – June 2025 – NO CHANGE

Here are the highlights:

- Interest Rate Hold:

- Bank of Canada held interest rates, maintaining Prime Rate of 4.95%

- This is the second consecutive meeting they’ve held rates

- The total number rate cuts this cycle remains at 2.25%.

- Economic Indicators:

- GDP stronger than expected at 2.2%

- Global economy holding up due to temporary surge in activity ahead of tariffs

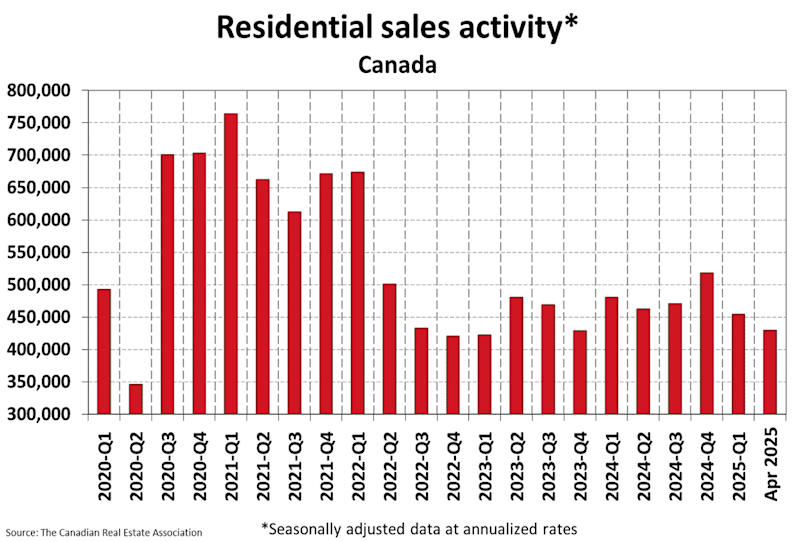

- Home sales still at very low levels.

- Tariff uncertainty continuing to plague consumption & investment

- Job Market:

- Employment barely changed in April after a decline in March

- Unemployment continues to rise, now at 6.9%

- Manufacturing hit hardest in Canada

- Forecasts:

- 5 of the 6 Big Banks forecast further rate cuts in 2025:

- 0.5% – 0.75%

- 0.5% – 0.75%

- 5 of the 6 Big Banks forecast further rate cuts in 2025:

- Next Bank of Canada Meeting:

- July 30th, 2025

The Bank of Canada has left rates unchanged for a second consecutive meeting, leaving prime rate at 4.95%.

While there are more Bank of Canada cuts being expected this year, rising core inflation & better than expected GDP has given enough cause to pause & save those cuts for economic decline coming later this year.

Tariff uncertainty remains high. The global economy & Canada’s economy has held up over the last few months, however that’s largely due to a temporary surge in activity – rushing in orders & stockpiling inventory – to get ahead of tariffs.

That said, consumption has slowed, business investment & confidence is down & housing is at some of the lowest levels since the depths of the pandemic, and this is expected to be the most robust quarter for growth this year – eesh!

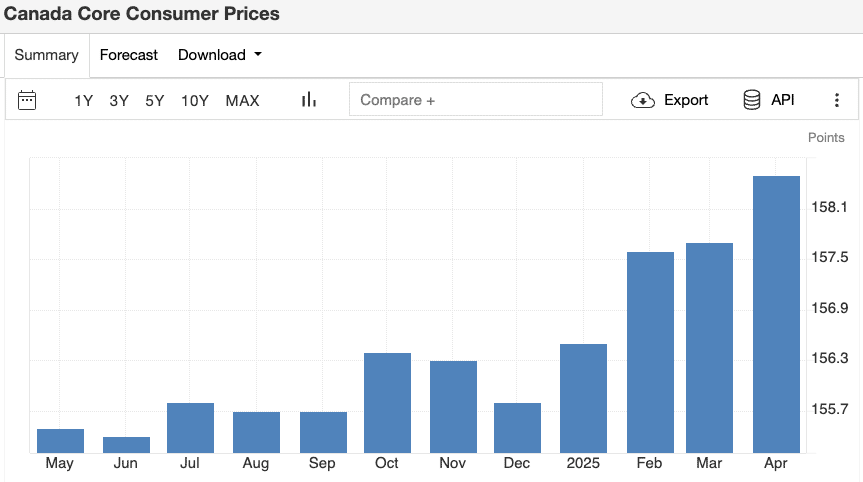

On the inflation front, CPI eased to 1.7% in April as the elimination of the carbon tax reduced inflation by 0.6%. The Bank’s preferred measure of core inflation, however, has moved up & is above target. That likely had a large impact on why the Bank hit pause today.

Core inflation excludes certain volatile components & can reflect underlying, longer term trends in the economy.

Consumers are expecting higher prices from the tariffs. When consumers are expecting higher prices, business are more able to pass on price hikes & inflation can continue to pick up & managing that, ultimately, is the Bank of Canada’s mandate.

So, overall, more Bank of Canada cuts are expected, fixed rates may be at the bottom & if you have a renewal coming up & we have not connected, get in touch today.