Bank of Canada Rate Announcement October- no change!

The Bank of Canada kept rates unchanged today in their scheduled rate announcement. The economic rebound in Canada has been better than expected but as we now face a second wave, much of the current outlook is dependent on how covid plays out here at home. Housing has been strong. Personally I’ve seen a lot of clients migrating from the downtown core to places like Victoria, the interior & further out in the lower mainland. Working from home is something many are taking advantage of by upgrading for space.

Of course these record low mortgages rates are a big reason for housing’s strength so how does the interest rate forecast look currently? Officially, the Bank of Canada has said they don’t expect to be raising rates until after 2022. They want to hit a 2% inflation target before moving to any increases & they expect inflation to start to pick up slowly early next year.

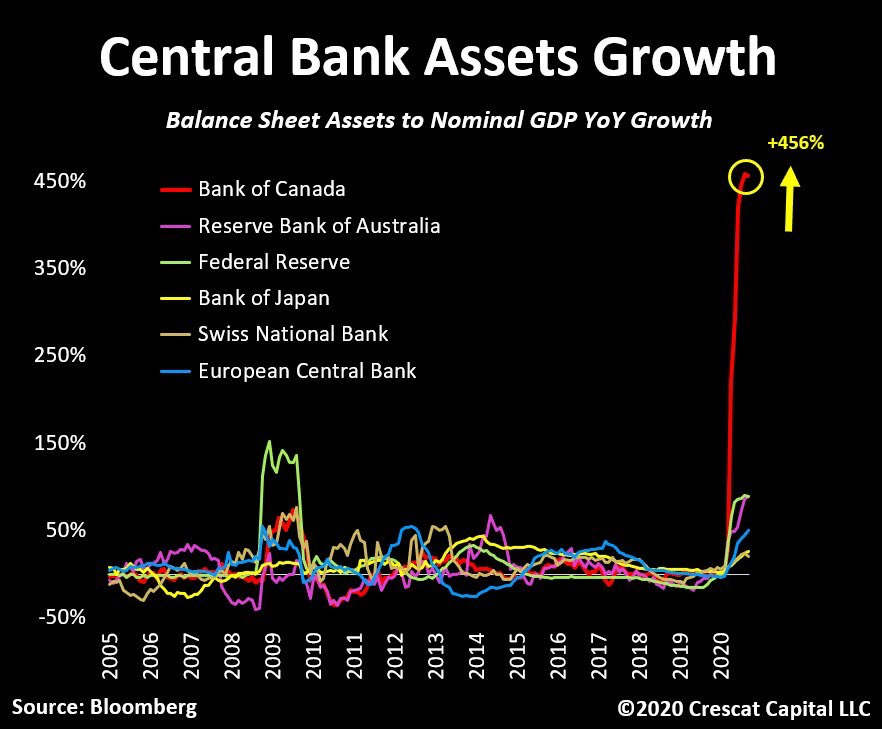

The Bank is also continuing its bond purchase program, which suppresses yields (and interest rates). I wanted to include this chart as it really illustrates the eye popping balance sheet growth of Canada’s central bank compared to others around the world since the pandemic started.

Currently our central bank owns 1/3 of our federal debt… so we’re generating debt then buying our own debt. Yes this is something many central banks are doing globally, but as soon as inflation expectations pick up, that means more bond buying is required (so more increases to the balance sheet) in order to keep interest rates from rising. It can turn into a vicious cycle where the end result does not fare well for our currency & the cost of goods.

I don’t think we’ll see much of a change in outlook until the end of this year but we have one more rate announcement coming up in December so will update you then.

That’s it for me today. Thanks for watching & have a lovely Wednesday.